New York City’s Largest Taxi Insurer Faces Insolvency, Threatening Transit Crisis

Title: American Transit Insurance Co.: A Crisis Looms Over NYC’s Taxi Insurance Landscape

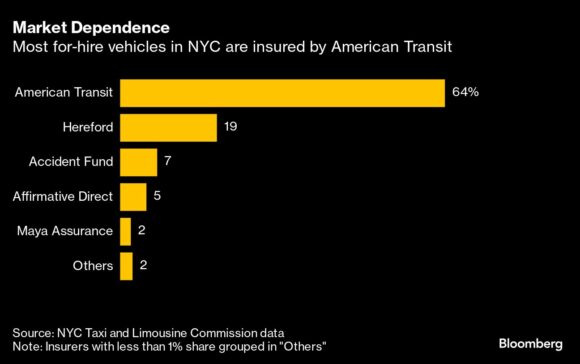

In a modest, yet pivotal, white and blue building in Freeport, Nassau County, lies the headquarters of American Transit Insurance Company (ATIC). Despite being a family-owned firm for over 52 years, ATIC is hardly a household name. However, its influence is undeniable; the company plays a crucial role in New York City’s transportation ecosystem, insuring approximately 60% of the city’s commercial taxis, livery cabs, black cars, and rideshare vehicles—a total of over 117,000 vehicles.

Unfortunately, there’s an unwelcome revelation—American Transit Insurance Co. is currently grappling with severe financial distress, as it is now officially insolvent.

The Downward Spiral: Financial Troubles and Implications

Under the leadership of Ralph Bisceglia, ATIC has historically dominated New York City’s commercial car insurance marketplace—one of the largest in the United States. The company was known for offering some of the lowest premiums to taxi drivers compared to its competitors. However, recent financial filings reveal a staggering shortcoming: more than 0 million in net losses in just the second quarter of the year, according to reports submitted to the National Association of Insurance Commissioners.

Tim Zawacki, a senior analyst at S&P Global Market Intelligence and a long-time observer of the insurance sector, stated, “To see this kind of loss of this size—there are few precedents.” The implications of ATIC’s fall from grace are significant. If the company cannot continue its operations, it could potentially leave thousands of taxi drivers without insurance, impacting an already complex transportation ecosystem in the city.

Regulatory Oversight and Potential Receiver Actions

The financial crisis at ATIC has escalated to the point where it has triggered a “mandatory control level event,” a serious designation that may lead New York’s Department of Financial Services (DFS) to step in. This could involve placing the company into receivership or even liquidation. A report from consultant Huggins Actuarial Services has generated considerable concern among industry observers, highlighting the precarious financial position of ATIC.

The DFS has indicated that it is actively working with ATIC and various stakeholders to address these longstanding financial issues. Ensuring the stability of New York’s livery insurance market and safeguarding drivers and passengers alike is of utmost importance. However, it is evident that the road ahead is riddled with challenges.

The Impact on Drivers and the Industry

Industry insiders voiced concerns that ATIC’s downfall could leave a significant gap in the market. Andrew Don, the COO of Research Underwriters, expressed that there is a common belief that ATIC is “too big to fail.” If ATIC were to collapse, there would be a sudden lack of available insurance for taxi and rideshare drivers. Don noted that other insurers might struggle to handle the influx of business from ATIC’s departure, potentially resulting in skyrocketing premiums for drivers across the board.

This speculation comes at a time when the taxi industry is already facing mounting pressures: stiff competition from rideshare services, plummeting medallion values, and other external economic challenges. If taxi drivers are suddenly subjected to higher insurance costs, it could further jeopardize an already fragile industry.

Findings from Past Evaluations and Future Considerations

Interestingly, ATIC has faced scrutiny regarding its pricing strategies for years. It has been reported that the company has underpriced its insurance products, taking in business from competitors while not charging premiums that adequately reflect the risks involved. This approach raises serious doubts about ATIC’s ability to pay claims—worries that have even resulted in a lawsuit against the company by Uber Technologies Inc. concerning claims-handling practices.

A report from early 2021 indicated that ATIC was approximately 0 million short of the necessary funds to cover its outstanding losses and expenses. Such findings are exceptionally rare in the insurance sector and raise alarms about the long-term sustainability of ATIC’s operations.

What Lies Ahead

As American Transit Insurance Co. faces this existential crisis, all eyes will remain firmly focused on the DFS and the measures they will take to rectify the situation. The fate of thousands of taxi drivers could very well rest upon the decisions made in the coming weeks and months. An already beleaguered industry may be on the brink of further upheaval if swift and effective action is not taken.

In conclusion, while we await developments on ATIC’s future, one thing is clear: the stability of New York’s transportation industry could hang in the balance over the actions of a single company that, for better or for worse, has shaped the way New Yorkers get around for decades.